The largest part of Ukraine's state debt is concessional financing from international partners

-

About Ministry

- Recruitment

-

Accountable agencies

- State Enterprises and Institutions Belonging to the Sphere of Management of the Ministry

- State Service for Financial Monitoring

- State Treasury

- The State Audit Service of Ukraine

- State Tax Service of Ukraine

- State Customs Service of Ukraine

- Personnel Audit Procedures of State Customs Service

- State Tax University

- Minfin Panel

-

Policy Issues

- Budget policy

- Tax Policy

-

Customs Policy

-

Integration of customs legislation into EU law

- Direct and indirect customs representation: possible scenarios for declaring goods and the role of a customs broker

- Customs representative and customs holder: who submits and signs documents

- Confirmation of the reliability of credentials for obtaining authorizations

- Authorization to carry out customs brokerage activities

- Integration of customs IT systems to MASP-C

-

Integration of customs legislation into EU law

-

Accounting and Auditing

-

Accounting

-

Introduction of International Financial Reporting Standards

- Translation of International Financial Reporting Standards 2025 (to be completed)

- Translation of international financial reporting standards of 2024

- Translation of international financial reporting standards of 2023

- Translation of the 2022 International Financial Reporting Standards and the Conceptual Framework for Financial Reporting

- Archive of translations

- Taxonomy

- Translation of technical publications

- General Clarifications (filled in after the preparation of the relevant letters of explanation)

- Accounting in Private Sector

- Accounting in the Public Sector

- Methodological Accounting Council under the Ministry of Finance of Ukraine (download a short description)

- IFRS Council under the Ministry of Finance of Ukraine (download a short description)

-

Introduction of International Financial Reporting Standards

- Auditing

- Sustainability reporting

-

Accounting

-

Debt policy

- Overview

- Debt News

- Debt Statistics

- Domestic Bonds

- Primary Dealers

- Eurobonds

- Credit Rating

- Investor Relations

- DMO Awards

- Anti-money laundering policy (AML)

- Financial Policy

- National revenue strategy

-

International Cooperation

- Partners

-

Cooperation in Attracting Financing from the International Financial Institutions

- Development Bank of the Council of Europe

- Procedure for attracting funds of International Financial Institutions

- World Bank

- EBRD

- EIB

- Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH

- KFW

- Register of Joint IFIs Projects at the Stage of Preparation and Implementation (information)

- International Technical Assistance (within the competence of the Ministry of Finance)

- Monitoring of international technical assistance projects

- Cooperation with the Development Partners

- International Tax Relations

- Development of Public Internal Financial Control (PIFC)

-

Public investment management

- Regulatory documents

- Implementation of the roadmap for reforming the management of public investments

- Unified portfolio of public investment projects (list of priority public investment projects)

- Interdepartmental working group on reforming the public investment management system

- Reference information

-

Other Areas of Public Policy

- Internal Audit

- Audit Committee of the Ministry of Finance of Ukraine

- Scientific and scientific and technical activity

- Reform Support Team at the Ministry of Finance of Ukraine

- Verification of State Social Payments

-

Fiscal Risks Managament

- Clarifications

- Legislation on Fiscal Risks Management

- List of Economic Entities with which Major Fiscal Risks May Be Related

- Reports

- List of business entities to which the Ministry of Finance approves proposals for individual financial indicators for the planning period, as well as proposals for maximum thresholds for the volume of capital investments

- Operations with precious stones and metals

- Licensing

- Public Finance Management Strategy (PFMS)

- Strategic Plan

-

Legislation

-

Regulatory Activity

- Reports on tracking the effectiveness of regulatory acts in 2025.

- Activity plan of the Ministry of Finance of Ukraine for project preparation regulatory acts in 2025

- reports_on_the_effectiveness_of_regulatory_acts_2024

- The activity plan for the preparation of the regulatory acts draft 2024

- Schedule of measures to monitor the effectiveness of regulatory acts 2024

- reports_on_the_effectiveness_of_regulatory_acts_2023

- The activity plan for the preparation of the regulatory acts draft 2022

- Schedule of measures to monitor the effectiveness of regulatory acts 2023

- Reports on the effectiveness of regulatory acts 2022

- The activity plan for the preparation of the regulatory acts draft 2022

- Schedule of measures to monitor the effectiveness of regulatory acts 2022

- Reports on the effectiveness of regulatory acts 2020

- The activity plan for the preparation of the regulatory acts draft 2021

- Schedule of measures to monitor the effectiveness of regulatory acts 2021

- Reports on the effectiveness of regulatory acts 2020

- The activity plan for the preparation of the regulatory acts draft 2020

- Schedule of measures to monitor the effectiveness of regulatory acts 2020

- Reports on the effectiveness of regulatory acts 2019

- The activity plan for the preparation of the regulatory acts draft 2019

- Schedule of measures to monitor the effectiveness of regulatory acts 2019

- Reports on the effectiveness of regulatory acts 2018

- The activity plan for the preparation of the regulatory acts draft 2018

- Schedule of measures to monitor the effectiveness of regulatory acts 2018

- Reports on the effectiveness of regulatory acts 2017

- The activity plan for the preparation of the regulatory acts draft 2017

- Schedule of measures to monitor the effectiveness of regulatory acts 2017

- Reports on the effectiveness of regulatory acts 2016

- The activity plan for the preparation of the regulatory acts draft 2016

- Schedule of measures to monitor the effectiveness of regulatory acts 2016

- Reports on the effectiveness of regulatory acts 2015

- The activity plan for the preparation of the regulatory acts draft 2015

-

Draft Regulatory Acts Discussion

- Draft regulatory acts for discussion in 2025.

- Regulatory acts draft for discussion 2024

- Regulatory acts draft for discussion 2023

- Regulatory acts draft for discussion 2022

- Regulatory acts draft for discussion 2021

- Regulatory acts draft for discussion 2020

- Regulatory acts draft for discussion 2019

- Regulatory acts draft for discussion 2018

- Regulatory acts draft for discussion 2017

- Regulatory acts draft for discussion 2016

- Regulatory acts draft for discussion 2015

- Draft Legislation

-

Regulatory Activity

-

Data

- Cooperation with Civil Society

- Press Center

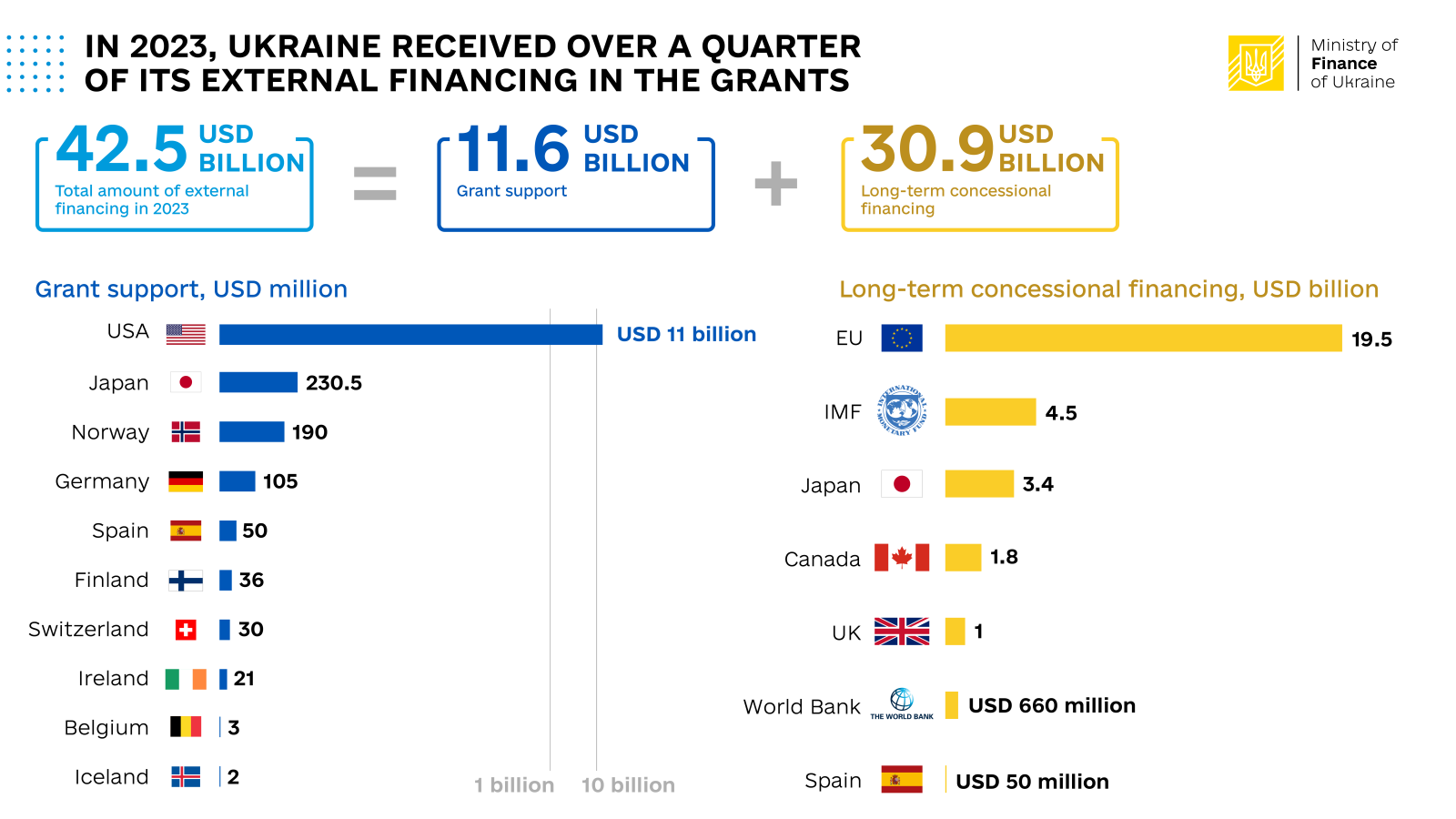

In 2023, Ukraine received external financing totaling USD 42.5 billion, of which USD 11.6 billion (or 27%) was a non-repayable grant aid.

Grant assistance was provided by the following countries: The United States, Japan, Norway, Germany, Spain, Finland, Switzerland, Ireland, Belgium, and Iceland.

Long-term concessional financing totaled USD 30.9 billion. This included loans from the EU (USD 19.5 billion), the IMF (USD 4.5 billion), Japan (USD 3.4 billion), Canada (USD 1.8 billion), the UK (USD 1 billion), the World Bank (USD 660 million), and Spain (USD 50 million).

Funds from the European Union were attracted as part of Macro-Financial Assistance. Loans under the EU Macro-Financial Assistance have a 35-year maturity (including a 10-year grace period), and the EU compensates the servicing expenses.

As of the end of 2023, the weighted average cost of state and state-guaranteed debt amounted to 6.24%, which is 1.4% less than in the previous year.

Meanwhile, the weighted average maturity of Ukraine's state and state-guaranteed debt increased by more than 2 years to 10.56 years last year.

In 2023, the total amount of Ukraine's state and state-guaranteed debt increased by UAH 1,444 billion in the hryvnia equivalent and by USD 33.9 billion in the dollar equivalent. The increase was mainly attributed to an inflow of long-term concessional financing from international partners.

As of December 31, 2023, Ukraine's state and state-guaranteed debt amounted to UAH 5,519.5 billion, or USD 145.3 billion. This includes: state and state-guaranteed external debt - UAH 3,863 billion (69.99% of the total amount of state and state-guaranteed debt), or USD 101.7 billion. State and state-guaranteed domestic debt - UAH 1,656.5 billion (30.01%), or USD 43.6 billion.

The share of the state and guaranteed debt is dominated by concessional loans received from international financial institutions (IFIs) and foreign governments (51.5%), domestic securities issued (28.9%), external securities issued (16.7%), and loans received from commercial banks and other financial institutions (2.9%).

As of the currency structure of state and state-guaranteed debt, the share of state debt denominated in euros increased rapidly as a result of EU Macro-Financial Assistance, from 14% to 32.3% as of the end of 2021. As of the end of 2023, the share of state debt in hryvnia amounted to 27.2%, in US dollars - 26.2%, in Special Drawing Rights (IMF currency) - 11.3%, and in other currencies, including pounds sterling, Canadian dollars, and Japanese yen - 2.9%.

In 2023, the Ministry of Finance held 206 auctions for the issuance of domestic government bonds, attracting UAH 552.6 billion to finance the State Budget.

As of December 31, 2023, the refinancing rate of domestic government bonds was 150%, while the refinancing rate of hryvnia-denominated domestic government bonds was 172.6%, 111.2% in US dollars, and 126.4% in euros.

More detailed information on the state and state-guaranteed debt of Ukraine is available on the official website of the Ministry of Finance of Ukraine at the link.