The Government Made Decisions to Implement the Concept of a Single Legal Entity for the State Tax Service and the State Customs Service

-

About Ministry

- Recruitment

-

Accountable agencies

- State Enterprises and Institutions Belonging to the Sphere of Management of the Ministry

- State Service for Financial Monitoring

- State Treasury

- The State Audit Service of Ukraine

- State Tax Service of Ukraine

- State Customs Service of Ukraine

- Personnel Audit Procedures of State Customs Service

- State Tax University

- Minfin Panel

-

Policy Issues

- Budget policy

- Tax Policy

-

Customs Policy

-

Integration of customs legislation into EU law

- Direct and indirect customs representation: possible scenarios for declaring goods and the role of a customs broker

- Customs representative and customs holder: who submits and signs documents

- Confirmation of the reliability of credentials for obtaining authorizations

- Authorization to carry out customs brokerage activities

- Integration of customs IT systems to MASP-C

-

Integration of customs legislation into EU law

-

Accounting and Auditing

-

Accounting

-

Introduction of International Financial Reporting Standards

- Translation of International Financial Reporting Standards 2025 (to be completed)

- Translation of international financial reporting standards of 2024

- Translation of international financial reporting standards of 2023

- Translation of the 2022 International Financial Reporting Standards and the Conceptual Framework for Financial Reporting

- Archive of translations

- Taxonomy

- Translation of technical publications

- General Clarifications (filled in after the preparation of the relevant letters of explanation)

- Accounting in Private Sector

- Accounting in the Public Sector

- Methodological Accounting Council under the Ministry of Finance of Ukraine (download a short description)

- IFRS Council under the Ministry of Finance of Ukraine (download a short description)

-

Introduction of International Financial Reporting Standards

- Auditing

- Sustainability reporting

-

Accounting

-

Debt policy

- Overview

- Debt News

- Debt Statistics

- Domestic Bonds

- Primary Dealers

- Eurobonds

- Credit Rating

- Investor Relations

- DMO Awards

- Anti-money laundering policy (AML)

- Financial Policy

- National revenue strategy

-

Financial Monitoring

- Statements and reports of international organizations

- Legislation

- International standards

- Methodological assistance (recommendations and explanations)

- Education, trainings and seminars

- List of states (jurisdictions) that do not comply or improperly implement the recommendations of international and intergovernmental organizations involved in the field prevention and counteraction

- List of persons to whom sanctions have been applied

- List of terrorists

- Send a report on violation of the legislation in the field of prevention and counteraction to legalization (laundering) of proceeds from crime, terrorist financing and financing of proliferation of weapons of mass destruction

-

International Cooperation

- Partners

-

Cooperation in Attracting Financing from the International Financial Institutions

- Development Bank of the Council of Europe

- Procedure for attracting funds of International Financial Institutions

- World Bank

- EBRD

- EIB

- Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH

- KFW

- Register of Joint IFIs Projects at the Stage of Preparation and Implementation (information)

- International Technical Assistance (within the competence of the Ministry of Finance)

- Monitoring of international technical assistance projects

- Cooperation with the Development Partners

- International Tax Relations

- Development of Public Internal Financial Control (PIFC)

-

Public investment management

- Regulatory documents

- Implementation of the roadmap for reforming the management of public investments

- Unified portfolio of public investment projects (list of priority public investment projects)

- Interdepartmental working group on reforming the public investment management system

- Reference information

-

Other Areas of Public Policy

- Internal Audit

- Audit Committee of the Ministry of Finance of Ukraine

- Scientific and scientific and technical activity

- Reform Support Team at the Ministry of Finance of Ukraine

- Verification of State Social Payments

-

Fiscal Risks Managament

- Clarifications

- Legislation on Fiscal Risks Management

- List of Economic Entities with which Major Fiscal Risks May Be Related

- Reports

- List of business entities to which the Ministry of Finance approves proposals for individual financial indicators for the planning period, as well as proposals for maximum thresholds for the volume of capital investments

- Operations with precious stones and metals

- Licensing

- Public Finance Management Strategy (PFMS)

-

Legislation

-

Regulatory Activity

- Reports on tracking the effectiveness of regulatory acts in 2025.

- Activity plan of the Ministry of Finance of Ukraine for project preparation regulatory acts in 2025

- reports_on_the_effectiveness_of_regulatory_acts_2024

- The activity plan for the preparation of the regulatory acts draft 2024

- Schedule of measures to monitor the effectiveness of regulatory acts 2024

- reports_on_the_effectiveness_of_regulatory_acts_2023

- The activity plan for the preparation of the regulatory acts draft 2022

- Schedule of measures to monitor the effectiveness of regulatory acts 2023

- Reports on the effectiveness of regulatory acts 2022

- The activity plan for the preparation of the regulatory acts draft 2022

- Schedule of measures to monitor the effectiveness of regulatory acts 2022

- Reports on the effectiveness of regulatory acts 2020

- The activity plan for the preparation of the regulatory acts draft 2021

- Schedule of measures to monitor the effectiveness of regulatory acts 2021

- Reports on the effectiveness of regulatory acts 2020

- The activity plan for the preparation of the regulatory acts draft 2020

- Schedule of measures to monitor the effectiveness of regulatory acts 2020

- Reports on the effectiveness of regulatory acts 2019

- The activity plan for the preparation of the regulatory acts draft 2019

- Schedule of measures to monitor the effectiveness of regulatory acts 2019

- Reports on the effectiveness of regulatory acts 2018

- The activity plan for the preparation of the regulatory acts draft 2018

- Schedule of measures to monitor the effectiveness of regulatory acts 2018

- Reports on the effectiveness of regulatory acts 2017

- The activity plan for the preparation of the regulatory acts draft 2017

- Schedule of measures to monitor the effectiveness of regulatory acts 2017

- Reports on the effectiveness of regulatory acts 2016

- The activity plan for the preparation of the regulatory acts draft 2016

- Schedule of measures to monitor the effectiveness of regulatory acts 2016

- Reports on the effectiveness of regulatory acts 2015

- The activity plan for the preparation of the regulatory acts draft 2015

-

Draft Regulatory Acts Discussion

- Draft regulatory acts for discussion in 2025.

- Regulatory acts draft for discussion 2024

- Regulatory acts draft for discussion 2023

- Regulatory acts draft for discussion 2022

- Regulatory acts draft for discussion 2021

- Regulatory acts draft for discussion 2020

- Regulatory acts draft for discussion 2019

- Regulatory acts draft for discussion 2018

- Regulatory acts draft for discussion 2017

- Regulatory acts draft for discussion 2016

- Regulatory acts draft for discussion 2015

- Draft Legislation

-

Regulatory Activity

-

Data

- Cooperation with Civil Society

- Press Center

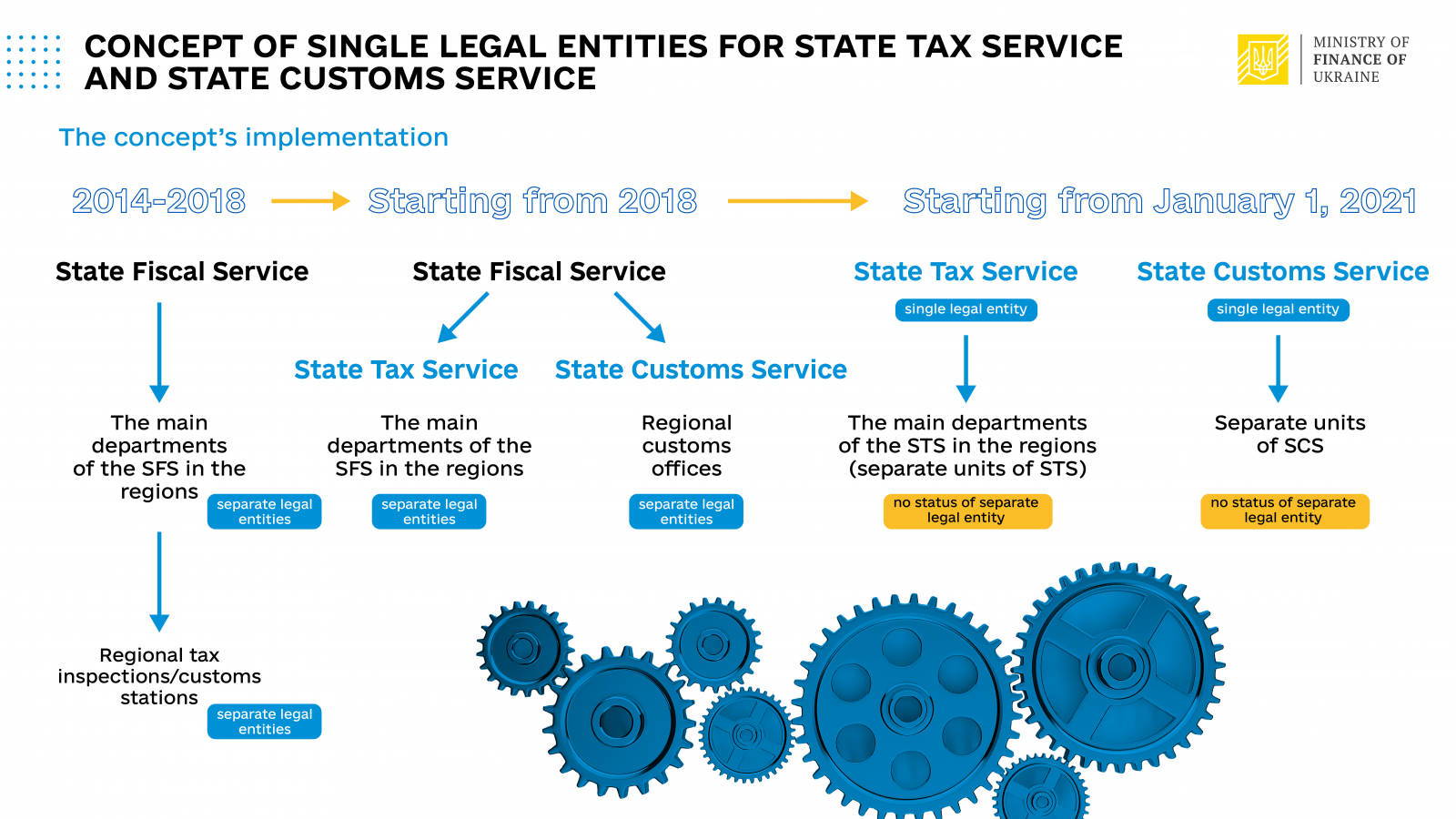

Today the Cabinet of Ministers of Ukraine adopted several decisions to ensure the functioning of the State Tax Service of Ukraine and the State Customs Service of Ukraine in the format of two single legal entities.

The concept of a single legal entity for the State Tax Service and the State Customs Service is a positive generally accepted European practice, which is implemented in Ukraine in accordance with previously adopted laws, as well as implementation of the structural benchmark within the current IMF Program.

The following deceisions were made:

- to dissolve territorial bodies of the State Tax Service as separate legal entities and to establish separate subdivisions of the State Tax Service (without the status of legal entities);

- to reorganize territorial bodies as separate legal entities into separate units of the State Customs Service.

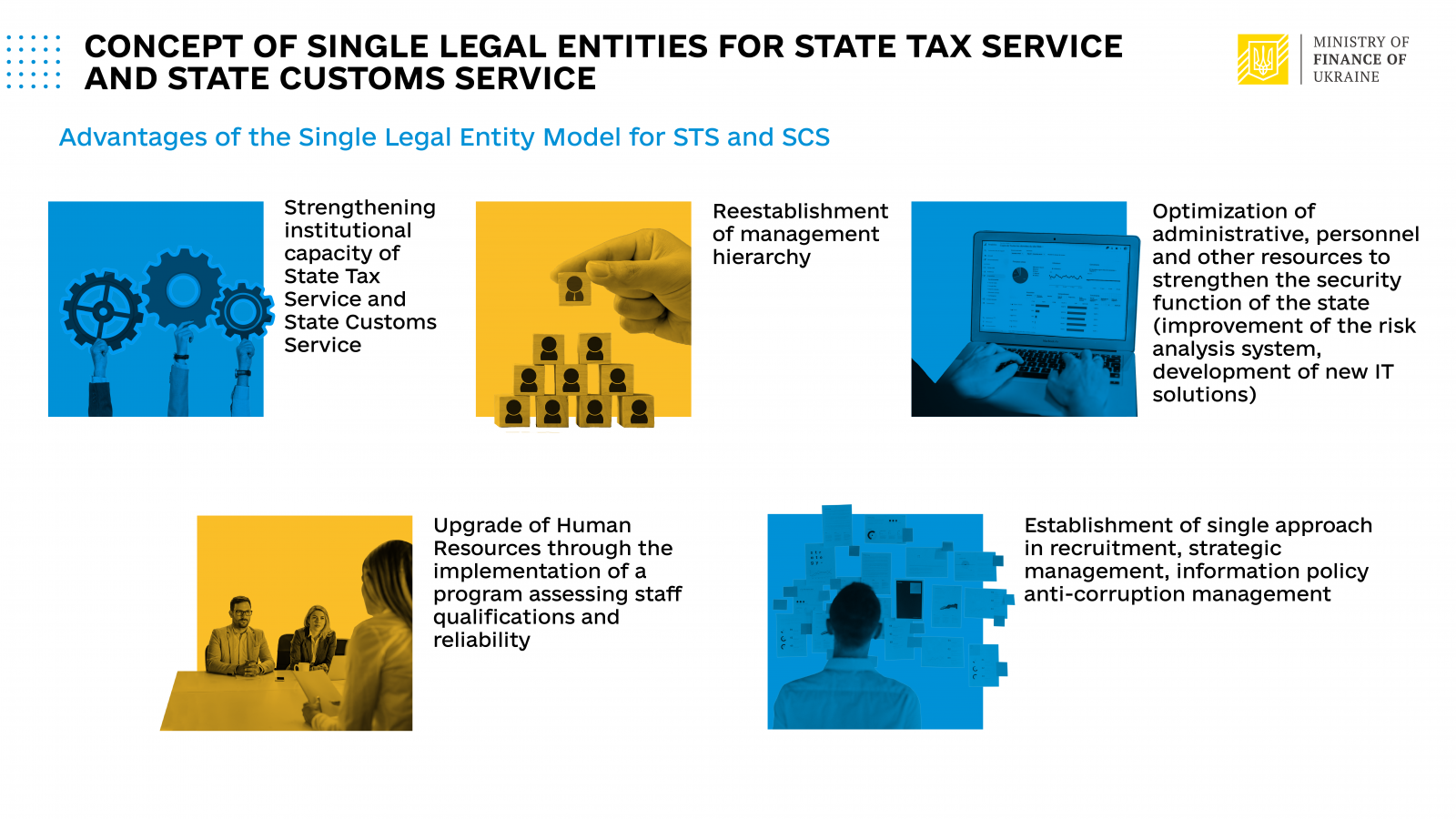

Positive aspects of the functioning of the State Customs Service and the State Tax Service according to the model of a single legal entity are the following:

- strengthening institutional capacity of State Tax Service and State Customs Service,

- establishment of management hierarchy,

- optimization of administrative, personnel and other resources to strengthen the security function of the state (improvement of the risk analysis system, development of new IT solutions),

- upgrade of Human Resources through the implementation of a program assessing staff qualifications and reliability,

- establishment of single approach in recruitment, strategic management, information policy anti-corruption management.

Thus, the creation of a single legal entity for each of these services will allow to introduce effective organizational structures of the State Tax and Customse Services, built on the functional principle, as well as to introduce new digital services, which will reduce time and money costs for bona fide business.

Reference:

The functioning of the State Tax Service of Ukraine and the State Customs Service of Ukraine in the format of two single legal entities is provided for in the third paragraph of subparagraph "g" of paragraph 1 of Article 1 of the Decree of the President of Ukraine of November 8, 2019 № 837 "On urgent measures to reform and strengthen the state" and Memorandum on economic and financial policy with the International Monetary Fund (deadline for the implementation of the structural benchmark is January 1, 2021).

Laws of Ukraine of January 16, 2020 № 466-IX "On Amendments to the Tax Code of Ukraine to improve tax administration, eliminate technical and logical inconsistencies in tax legislation" and January 14, 2020 № 440-IX "On Amendments to the Customs Code Of Ukraine and some other legislative acts of Ukraine in connection with the implementation of administrative reform" provide an opportunity to form territorial bodies of central executive bodies which implement state tax and customs policy, as separate units with the necessary powers.